Modularity and niche markets

Lessons from solar PV's scaling journey for climate technology startups

Modularity is an over-discussed topic regarding how to scale physical technology, so I was hesitant to write this essay. However I’ve recently been diving into the history of solar PV and have come to realise there should be a greater emphasis on linking this technology benefit with the right customer. Namely, linking modularity with niche markets.

What do I mean by this? I believe modular technology is too often discussed in isolation as the ideal technology approach, where a small base unit of a product has proven to have faster learning rates and be a preferred technology type when building mega projects.

But modularity in isolation is not the full monty. If we look at technology adoption, often it is slow. Adoption of transformative technology that is cheaper, better, faster and propels humanity forward can take decades.

Building modular technology, and using it to first sell to high-value/low volume customers, or niche markets, builds antifragility and the foundations for rapid scaling.

I recently read Greg Nemet’s book How Solar Energy Became Cheap, which is a comprehensive look at solar PV’s scaling journey over the last 150+ years.

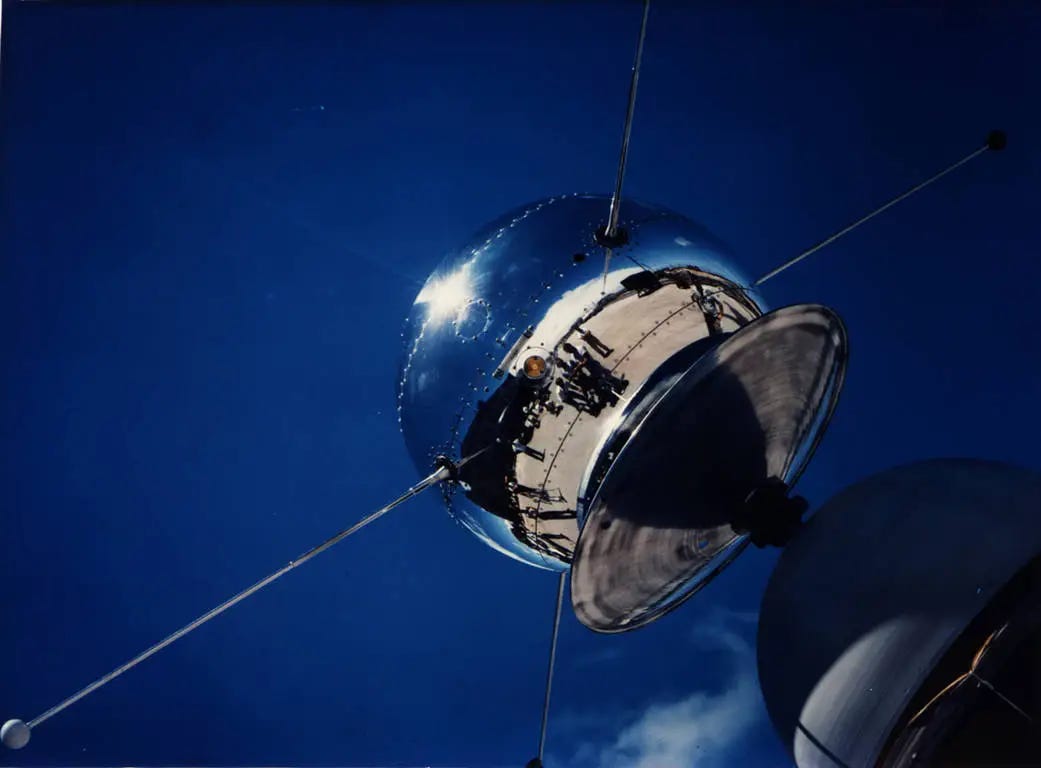

While the photovoltaic effect was discovered in 1839, its first commercial application started in 1954 when Bell Labs developed the first silicon solar cell with a 4% efficiency. The Cold War space race paved the way for solar’s first material customer - the U.S. space program. The U.S. space program adopted solar for satellites, starting with Vanguard I in 1958.

Vanguard Satellite, 1958 - NASA archives

The US Navy took a risk on solar for Vanguard-1 because they believed it would last longer and was 40% lighter than conventional mercury batteries. At the time, solar cost $1,000 per watt— for reference, a watt of solar comes in at less than $1 today. The Vanguard-1 solar cells powered the radio transmitter for six years and it proved solar PV to be a serious technology that could perform as required.

The US space program, particularly during the Cold War, was an ideal first customer. They were facing an existential threat having been on the back foot with the Soviets’ successful launch of Sputnik in October 1957. They represented what has been recently referred to as premium demand:

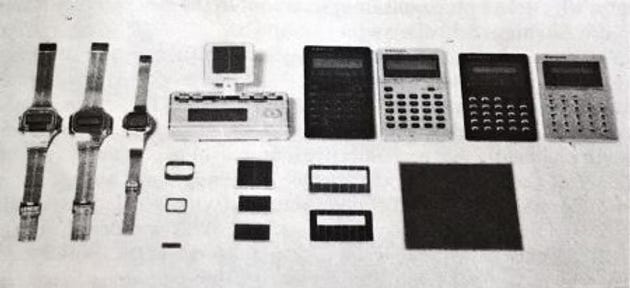

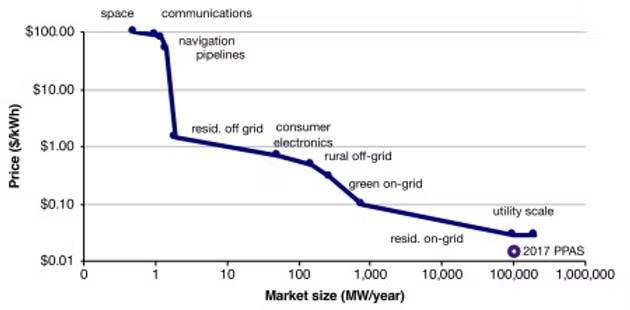

From 1958 to 1972, the US space program spent US$150 million on solar cells and deployed them onto roughly 1000 spacecraft. The US space program as a first customer led to the first wave of solar PV entrepreneurs - Hoffman Electronics in the US and Sharp in Japan. After space, these companies found applications in niche markets that required solar’s modularity - from telecom repeater stations, navigation systems for oil rigs, calculators, radios and even toys. Through the 1980s and 1990s, as solar PV ran down the cost curve, solar PV companies served increasingly larger market with decreasing willingness to pay:

Solar PV customer willingness to pay and market size at time of first application, How Solar Got Cheap

Importantly, the form-factor remained the same—a postage-stamp-sized solar cell producing less than a watt of power served the majority of these applications.

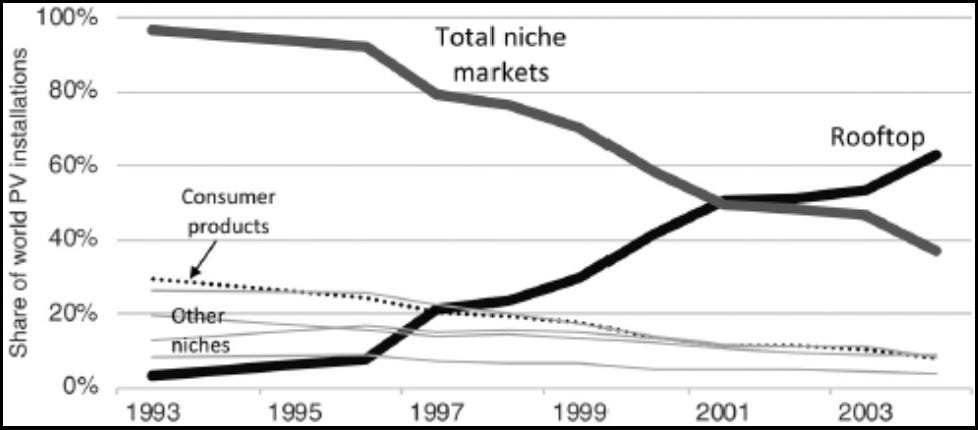

It is clear that policy support helped scale solar PV, but during the 1950s to 1990s, there were major policy hurdles solar PV had to overcome - from the continued solar versus nuclear debate in every country it scaled, to 1980s depressed energy prices and Reagan-era policies that deprioritised solar. However, it was arguably the niche markets that progressed the PV supply chain when policy support was lacking, so that it continued to scale for the ultimate end use cases of rooftop and utility scale deployments.

Share of global solar PV market by application area, How Solar Got Cheap

The takeaway I’m obviously trying to highlight is the combination of modularity and a niche market focus provides the financial runway to prove a learning rate that scales a technology. It provides a resilient framework to navigate adoption curves that accompany breakthrough innovation.

There are are obvious challenges, namely:

Serving niche markets can require a level of specialisation that feels at odds with scaling; and

Convincing talent and investors that the audacious quest requires a customer that seems like a detour from the ultimate vision.

But I believe a clear master plan can help solve this - one that articulates the compelling vision to change the future but is backed by concrete plans to do so.

Whilst first markets can sometimes feel counter intuitive, if a startup builds the modular technology and demonstrates the platform they’re building is able to limit the amount of custom work needed for each additional niche, it is often sound strategy. Looking at solar’s early applications, Hoffman Electronic and Sharp were able to do limited customisation of their products to serve multiple consumer electronics applications.

It’s also important to say that niche ≠ small. They are likely smaller than the largest obvious market, but the best niche markets are ones that will to grow fast. Take consumer electronics for solar PV - in the 1980s it was a few MWs of demand, now it is a >US$25bn annual spend category. Whilst it’s not the end-state of most startups' master plans, it’s a meaningful customer that wants the product so badly they pull the product out of the startup.

The current political environment for climate technology is one of heightened uncertainty. Whilst many technologies are entering the deployment phase, rising inflation concerns and changes in governments may create policy support vacuums.

Looking at solar PV gives me hope. While it took too long to scale, solar PV's ability to thrive through changing conditions wasn’t luck – modularity and a strategic focus from early entrepreneurs on niche markets kept the value chain growing.

For founders today, unlocking the full value of modularity with niche-first customer focus offers a way to navigate the turbulence and build resilience.